Owing the IRS doesn’t exactly inspire joy. Tax season can be stressful enough, but throw in a hefty bill, and things can feel overwhelming. The temptation to bury your head in the sand and avoid filing altogether might be strong, but resist it. I have found that not filing your taxes, even if you owe, can have far worse consequences than facing the debt head-on. Here’s why I believe filing is critical, even when the numbers aren’t in your favor:

1Bankruptcy: An Escape from Tax Debt

Contrary to popular belief, some federal income taxes can be discharged in bankruptcy. That’s right, a fresh start might be closer than you think. But there’s a crucial catch: to be eligible for this discharge, certain conditions must be met, and the most important one is timely filing.

Think of it like building a case for your financial hardship. Filing your taxes on time, even with outstanding debt, lays the groundwork for potential future bankruptcy relief. It creates a paper trail, proving you acknowledged your obligation and attempted to comply. Without that trail, the path to discharge becomes significantly murkier.

What Tax Debts Can Be Discharged?

Not all tax debts are created equal, and not all qualify for discharge in bankruptcy. Here’s a breakdown of the types of tax debts you can potentially wipe out:

- Federal and state income tax debt: This is the good news! Regular income taxes owed to the federal government or your state can be discharged under certain conditions.

- Penalties and interest: Late filing penalties and accrued interest on your income tax debt might also be discharged alongside the principal debt.

What Tax Debts Can’t Be Discharged?

Unfortunately, not all tax burdens can be relieved through bankruptcy. Here are some exceptions to keep in mind:

- Fraudulent tax debt: If you intentionally evaded paying taxes or filed fraudulent returns, bankruptcy won’t help in this case.

- Payroll taxes: Taxes withheld from your paycheck for Social Security and Medicare are considered trust fund taxes and cannot be discharged.

- Property taxes: These are not considered income taxes and cannot be eliminated through bankruptcy.

- Recent tax debt: You can only discharge income tax debt that is at least three years old as of the filing date for your bankruptcy petition.

Meeting the Eligibility Criteria:

To qualify for discharge of your income tax debt through Chapter 7 bankruptcy, you must meet all of the following conditions:

- Honest taxpayer: You must have filed accurate and timely tax returns for the years in question. Late filings or fraudulent returns can disqualify you from discharge.

- Three-year rule: The tax debt must be at least three years old as of the filing date for your bankruptcy petition.

- Two-year rule: You must have filed your tax returns at least two years before filing for bankruptcy.

- 240-day rule: The IRS must have assessed the tax debt at least 240 days before you file for bankruptcy, or it must not have been assessed yet.

Tax Liens and Bankruptcy:

It’s important to understand the difference between tax debt and tax liens. While bankruptcy can discharge your obligation to pay the debt itself, it won’t remove any existing tax liens on your property. This means that even if your debt is discharged, you’ll still need to pay off the lien before you can sell the affected property. However, there is a way to deal with these liens through a Chapter 13 Bankruptcy Plan.

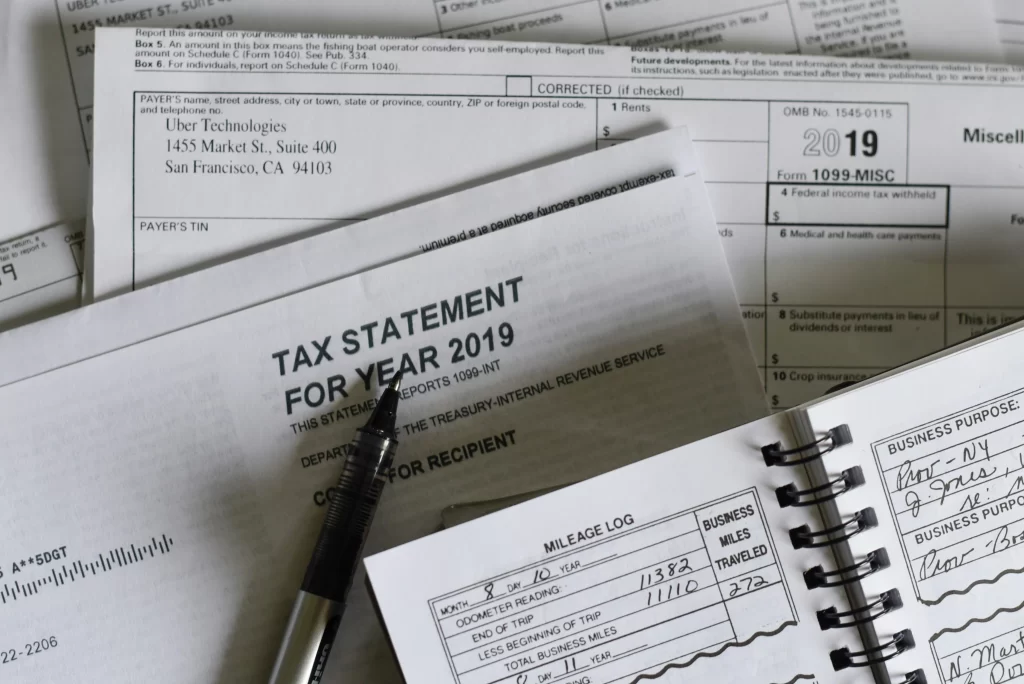

The Rise of the Gig Economy

The booming gig economy, with platforms like Uber and Lyft, introduces new income streams, but also new tax complexities. Many individuals in these jobs fail to account for the tax implications of their earnings, potentially leaving them with a nasty surprise come tax season.

However, by filing your taxes regularly, even if you can’t pay right away, you avoid a snowball effect. Late filing penalties and interest accrue quickly, making the debt even more daunting. Timely filing, even with partial payments, demonstrates good faith and can potentially lead to more favorable repayment options with the IRS.

Seeking Guidance: Professional Help is Available

Navigating IRS debt and bankruptcy options can be complex and overwhelming. Don’t go it alone. Consulting with a qualified bankruptcy attorney can provide invaluable guidance. They can assess your situation, explain your options, and help you develop a strategy to move forward.

Remember, the IRS and State Tax Authorities are not your enemy. They are willing to work with you, especially if you are proactive and demonstrate a willingness to comply. Open communication and timely filing go a long way in fostering a positive relationship with the tax authorities.

Filing your taxes, even with debt, is not a sign of weakness; it’s a responsible step towards resolving your financial challenges. It keeps your options open, lays the groundwork for potential future relief, and demonstrates good faith to the IRS. Don’t let fear of owing money prevent you from taking this essential step. Seek professional guidance, make informed decisions, and remember, with the right approach, you can overcome even the most daunting tax debt.